The new Uber Credit Card was announced this week, with applications beginning on November 2. It will offer customers who sign up a no-fee rewards program that could help subsidize the cost of a ride sharing addiction. I personally saw my Uber bills climb when I spent the summer in San Francisco, spending more time traveling to and from the airport and around the city. However, there are additional ways to earn Uber credits even if you don’t have this special credit card.

Benefits of the Uber Credit Card

Benefits of the Uber Credit Card

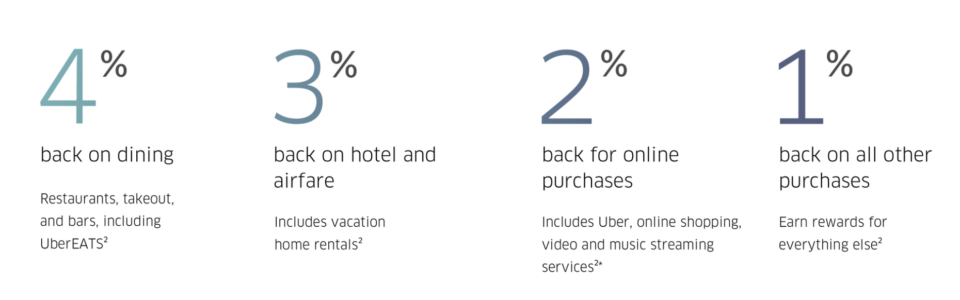

Let’s start with the card itself. For no annual fee, you get a product that’s been clearly designed with the millenial bon vivant in mind. Each point is worth 1 cent in Uber credits, and the sign up bonus at launch is 10,000 points after spending $500 within 90 days. You can earn additional points in the following purchase categories:

- 4% back on dining (including Uber Eats)

- 3% back on air travel and hotels

- 2% back on online purchases (including Uber)

- 1% back on everything else.

You’ll also get a $50 statement credit that you can use for online subscription services like Netflix if you spend $5,000 on the card each year.

Are There Better Alternatives?

If you’re the kind of person who likes cash back cards for their simplicity, then the Uber Visa Card could be a good choice, especially with no annual fee. However, don’t forget to compare it to some other popular options and your personal spending habits. It’s easy to find 2% cash back cards like the Citi Double Cash Card. Are the extra 4% and 3% on some categories going to make up for earning just 1% on everything else?

You might also find other ways to get value from points that aren’t strictly cash back. Consider the Chase Freedom Unlimited card. Strictly speaking, you earn 1.5 points per dollar on everything, and those points are worth 1 cent each when redeemed for cash. But if you also have a Chase Sapphire Reserve card for your travel and dining, then you earn 3 points per dollar on those purchases, and you can combine points from both cards while redeeming them for travel at a rate of 1.5 cents per dollar. Effectively, your rewards structure would look like this:

- 4.5% back on dining, including Uber Eats

- 4.5% back on air travel, hotels, Uber and all other travel

- 2.25% back on everything else, including online purchases

That strikes me as much more compelling than the Uber Visa Card, though it does require splitting your purchases between two different cards, and you have to get a super-premium Chase Sapphire Reserve with a $450 annual fee. (Fortunately the card includes a $300 annual travel statement credit, among other perks like lounge access.)

Earn Uber Credits without a Credit Card

There are other ways to get a discount on your next Uber trip. In late August Uber launched a partnership with Visa Local Offers so you can earn Uber credits each time you make a purchase at a local merchant. It’s incredibly easy to sign up and has no membership fee.

I don’t even pay attention to the list of participating merchants but have already been earning a few dollars a week, cutting the cost of my Uber ride home after visiting the bar on weekends. Many restaurants in particular offer 10-20% back. The only requirement is that you use the same card to pay at the store or restaurant that you use to pay for Uber.

This is pretty simple if you already use the Chase Sapphire Reserve, since you would want to take advantage of the same 3 points per dollar on travel (Uber) and dining (my favorite coffee shop). But if you still find the Uber Visa Card attractive, then you could double dip here, too. Essentially you would be earning 4% via credit card rewards and another 10-20% depending on the merchants agreement with Visa Local Offers.