The Chase Sapphire Preferred credit card is a popular choice for those who want to earn travel rewards and maximize their spending but not pay a high annual fee.The CSP offers a range of benefits and rewards. Points can be used for booking travel or paying oneself back. With a focus on travel, this card is a great choice for frequent travelers, including airline miles, hotel stays, and cash back. The card becomes even more powerful when matched with a card like the Chase Ink or Reserved. Allowing the transfer to transfer partners

Chase Sapphire Sign Up Offer

Like all new credit cards, one of the most appealing features is the sign-up bonus. The current sign up offer allows new card holders to earn 80,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening the account. There is a $95 annual fee for this card, which is not waived for the first year.

80,000 points are worth $1,000 in travel. As points can be redeemed at 1.25 cents a piece. Or stack your rewards with another credit card and transfer them to one of 14 transfer partners. Including both airlines and hotel partners.

Chase Sapphire Rewards

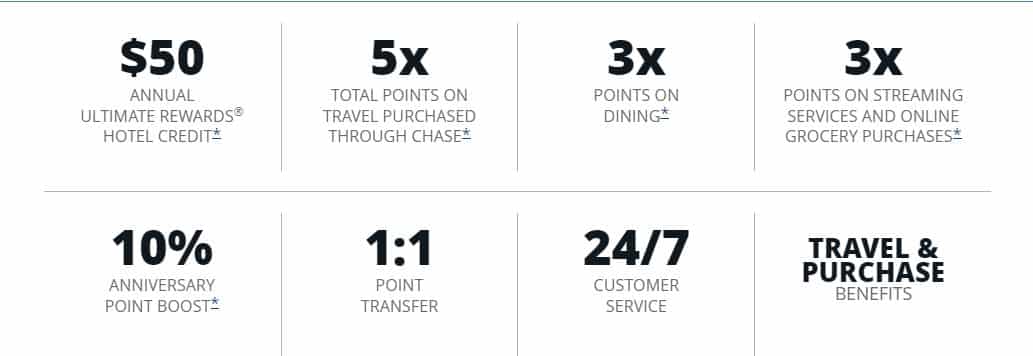

Beyond the sign up bonus offer you can earn points every day with this card. Chase ultimate reward points are easy to earn and stack up quickly. Earn points with every swipe of the card.

- 5x points per dollar on travel purchased through Chase Ultimate Rewards®, e $50 Annual Ultimate Rewards Hotel Credit

- 5x total points on Lyft rides through March 31st, 2025.*

- 3x points on dining at restaurants, including delivery like uber Eats and doordash

- 3x points on select streaming services

- 3x points from online grocery purchases

- 1x point everywhere else

The credit card earns points nearly everywhere. My favorite part of this card is Chase’s liberal use of restaurants. Unlike the American Express Gold card which earns 5x points at Restaurants, this card only earns 3x points. Yet, chase categorizes most bars as restaurants. Meaning you can earn 3x points while enjoying your sunday funday or dancing saturday night away.

The Chase Sapphire also has a $50 hotel credit which can help reduce the annual cost of the card. Book any prepaid stay via Chase’s ultimate rewards travel portal and receive a $50 statement credit, once annually.

Finally, for those who love to travel know that the Chase Sapphire Preferred card comes with additional travel protection. Use your card to book travel and receive the following protections every time.

- TRIP CANCELLATION/TRIP INTERRUPTION INSURANCE

- AUTO RENTAL COLLISION DAMAGE WAIVER=

- TRAVEL AND EMERGENCY ASSISTANCE SERVICES

- TRIP DELAY REIMBURSEMENT

- BAGGAGE DELAY INSURANCE

- LOST LUGGAGE REIMBURSEMENT

Bottom Line

The Chase Sapphire Preferred is offering 80,000 bonus points for a limited time to new card holders or those who have not had the card in the last 48 months. Remember you cannot have both a CSP and Chase sapphire Reserve. It is one or the other. The card annual fee is $95, which is relatively low compared to other travel rewards cards.

Overall, the Chase Sapphire Preferred credit card is a great choice for those who want to earn travel rewards and maximize their spending. Its sign-up bonus, rewards program, and travel benefits make it a popular choice among frequent travelers. While it does have an annual fee and foreign transaction fees, these drawbacks are offset by the benefits and rewards the card offers.