During an on-going analysis of hotel loyalty programs, I decided to take a look at the credit card bonuses each offered. There is an opportunity cost when you use a co-branded card rather than some other credit card. For example, you may give up 2.14 Ultimate Rewards points you could have earned with your Sapphire Preferred card on travel purchases. But sometimes the co-branded card offers a particularly good deal. For example, the Hyatt Credit Card offers 3 points per dollar. If you were going to transfer your Ultimate Rewards points to Hyatt anyway, then it would be much better to skip the middle man.

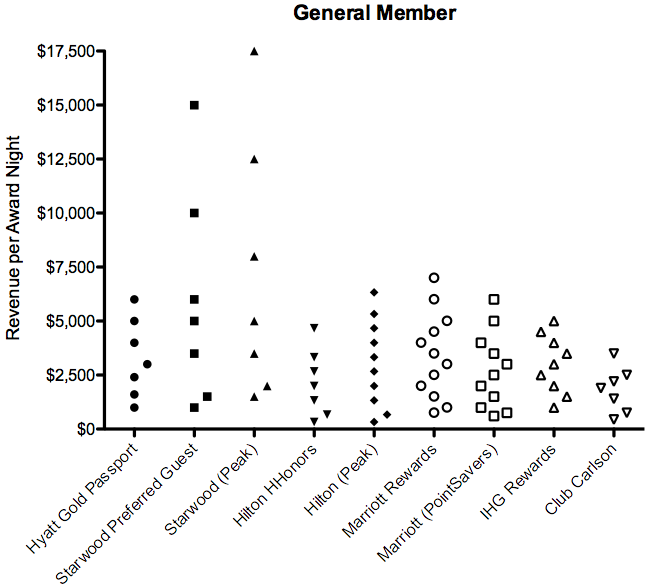

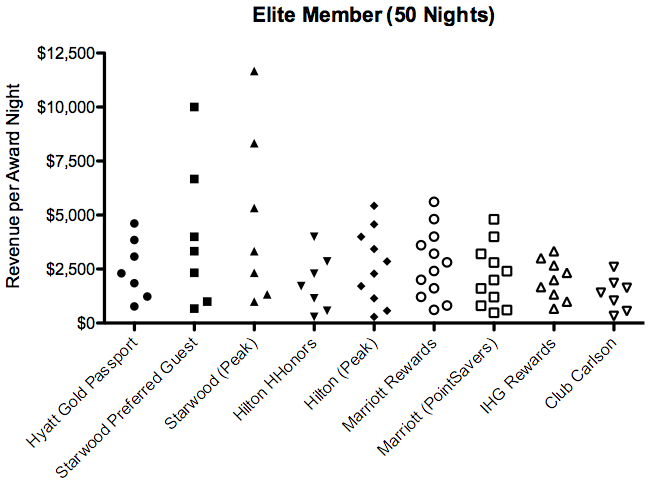

The first two charts show the distribution of award costs for each category in each program. I did this only for general members and for the top elite tier, originally publishing these a few weeks ago. The data show how elite status can rectify some remarkable disparities in a program’s award chart. For example, Starwood has the highest award costs due to its expensive Category 6 and 7 awards, but it offers a generous elite bonus. Instead of a 3-fold difference compared to other programs, Platinum status (at 25 stays/50 nights) results in a mere 2-fold difference.

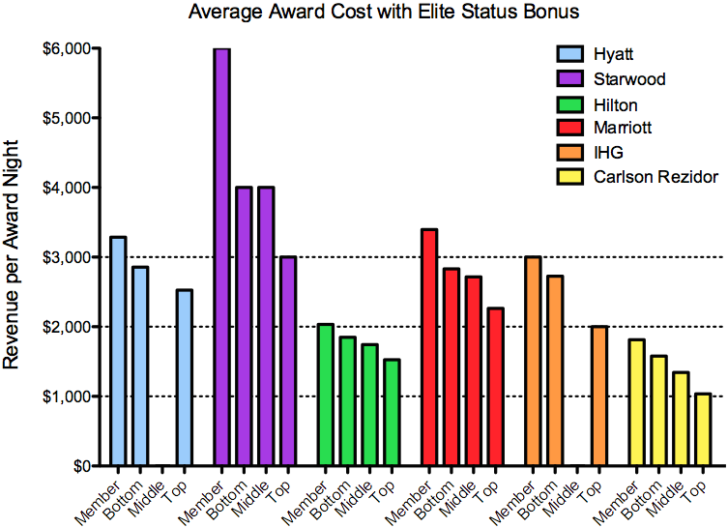

But what about changes between intermediate levels of elite status? All these dots are getting distracting, so I just averaged them together to create a single number for each program. (For example, Hyatt requires an average of 16,429 points per award night.) It’s important to note this is not a weighted average, which would be more useful information. But I don’t have the distribution of properties in each award category easily available and am not interested in counting them by hand.

As you can see from the chart, elite status has a large effect on the cost of an award night. It can reduce the amount of revenue required (dollars spent on paid nights) before earning an award by up to one-half or as little as less than one-third of the cost to a general member. The greatest discounts were provided to members of Starwood Preferred Guest and Club Carlson who stayed 75 nights or more each year, which makes some sense.

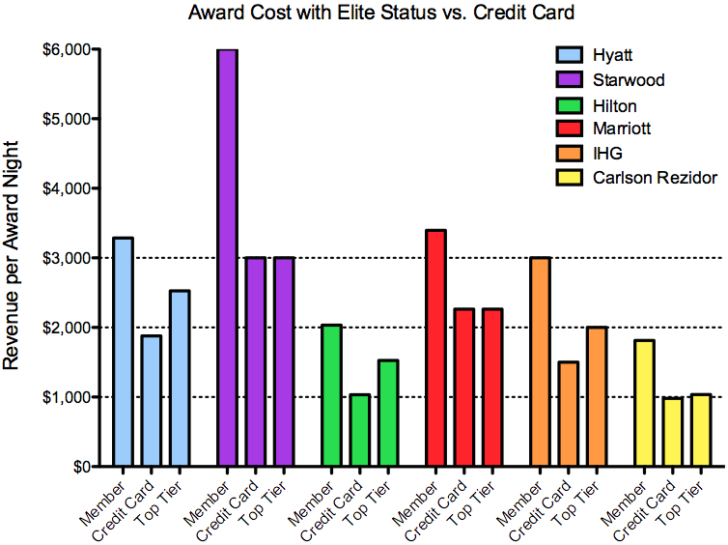

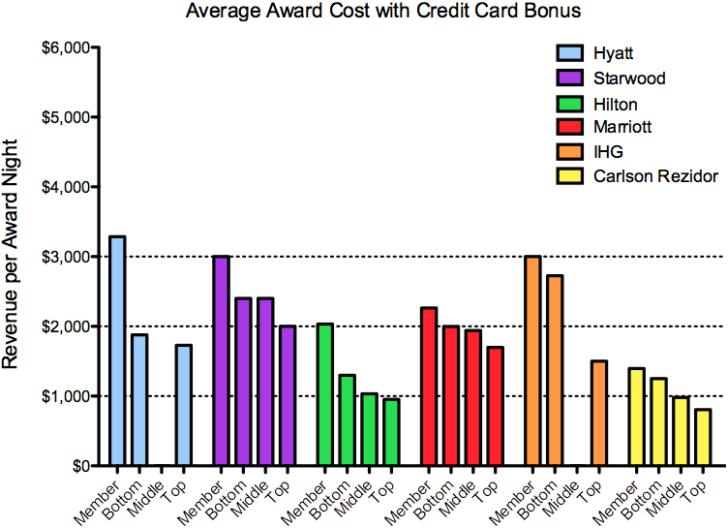

I then took a look at how the cost of an award changes when a co-branded credit card bonus is included. These numbers combine the elite status bonus (if any) and the credit card bonus.

These numbers really amazed me. While you could normally obtain 20-30% faster earning in most programs with top-tier status, adding a credit card could save close to 50%. So I created one final figure. What happens if we make a single choice: get a co-branded credit card or obtain top-tier status? I included the status that comes with the credit card, if any, but I assumed the top-tier elite member was not using a card.

With some programs, the effect is the same: Starwood and Marriott offer identical bonuses if you have their credit card or top-tier elite status. But for all the other programs, holding a co-branded credit card offers a greater discount on award nights than holding status. This effect was most noticeable for Hyatt Gold Passport and Hilton HHonors.

What surprised me the most? Hilton has some of the cheapest award nights of any hotel loyalty program considered here! It’s on par with Club Carlson. Obviously Hilton has a lot of mid-range properties that bring down its average, so this isn’t the same as saying it’s inexpensive to book a free night at the Conrad Hong Kong. But I still find it shocking.

Some readers also asked that I look at this from a different perspective: What if you get all your points from credit cards and manufactured spend? Then you probably don’t care about elite status or earning rates at all. You just want to know what’s the best card to put your spend on to earn a free night. I’m still working on that analysis and hope to have it later this week or early next week.