I generally like the service and benefits I receive for my American Express cards, but I have two nagging complaints. First, the system almost never logs me out completely. There’s always a cookie or something that gets confused if, for example, Megan tries to log in after me with the same browser. This is a minor irritation but leads into a much bigger problem: American Express consistently offers reduced sign-up bonuses on new card applications to customers who already hold existing cards.

I’ve noticed this before when trying to update the information on my credit card pages that compare offers from multiple banks and cards to try to provide you the best sign-up links. Since I don’t have an affiliate agreement with the U.S. division of American Express, I often find these offers directly on its own website or sometimes point you to someone else’s affiliate link. On more than one occasion I’ve seen an offer for something like 50,000 points, clicked on the link to confirm, and found myself with a page that offered something much less.

The only solution I’ve been able to identify so far is to use a new browser with all tracking information cleared or — much simpler — use a Google Chrome incognito window that does effectively the same thing on a temporary basis.

There are two main examples of this selective presentation of information to existing vs. new customers. I’m not entirely opposed to it because it can be helpful.

Explanation 1: Existing Cardholders Have Different Needs

I currently have a standard, no-fee Hilton HHonors card from American Express. If I go back to the same application page for this card, I don’t really need to see an application. I am probably more interested in details about the card’s benefits or an upgrade offer to the Hilton HHonors Surpass card, which is what I get instead. The only reason I really want the original offer is because I’m checking up on it for you guys, but I’m a unique case. American Express deserves credit for providing the most useful information to the person based on information it already has about him or her.

But I also think American Express is doing itself a disservice by providing existing customers lower offers. Maybe that’s because it sees their business as less valuable. I think you guys deserve a warning because you might click on a link that says one thing and not notice that the offer terms change on the actual application.

Explanation 2: Existing Cardholders are Less Valuable

I have the no-fee Hilton card above, as well as two SPG cards (personal and business), a personal Premier Rewards Gold card, and a Business Platinum card. I don’t know exactly how many cards it takes to tip the balance, but the offers I receive when I click on new application links are about half as generous as they are advertised to be. I’ll give you a walkthrough below.

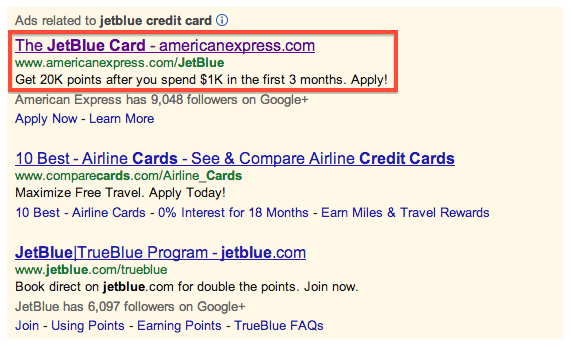

When I search for a card, I usually start with what I can find publicly on Google. It’s easiest, even though I do try to confirm with other sources (more than once another source has promised a better deal, but their link is dead). Here’s an offer I got in the advertised section of the Google search results for the JetBlue card:

Then when I click to open the offer in my normal browser window, I get something much less generous. Only half as many bonus points, and the annual fee is not waived the first year. Keep in mind that while I do use this same browser window to sign-in to my American Express account, I had recently logged out. Apparently they’re still tracking me.

That’s odd. So I opened the advertised link again in an incognito window. This time I get the better offer. In fact, a lot of the artwork is different, too. It’s like a completely different offer!

The URL I attempted to reach for both offers was exactly the same regardless of which browser I use. Here’s the address I used (after stripping out the tracking code that identifies me as a visitor from Google). It works fine using the incognito window:

But using a standard window and typing in the same address, I get redirected to a different URL with the lower offer:

This phenomenon is not unique to the JetBlue card. I’ve seen similar downgraded offers when I look to apply for the Gold Delta SkyMiles Card (30K vs. 10K) and the personal Platinum Card (25K vs. nothing). It’s a little difficult to test other offers since I have many of the cards already. (I only see the card benefits and not an application pitch.)

As I said, there are perfectly justifiable reasons for American Express to change the information it presents. One is to provide more useful data to a customer who already holds that card. Another is to provide a tailored offer to someone who promises less incremental revenue. The first is pro-consumer, the second is not, but both make good business sense. But now you know you should be on the watch. I have made a habit of only applying for new American Express cards with an incognito window, and I also verify the offer details and take screenshots. You would be wise to do the same.