Following rumors originally published by Doctor of Credit and later confirmed by The Points Guy, Chase will be increasing the annual fee on its super premium Chase Sapphire Reserve credit card to $550, matching the fee for the American Express Platinum Card. A lot of people are upset about this, and some have talked about closing their accounts and switching to Amex because “at least they offer Centurion Lounge access.”

That’s true. Amex does have a better lounge program for some. But there are others, like me, who will continue to use the Sapphire Reserve card. And I say that as someone who is blacklisted from Chase (my wife made me an authorized user).

Despite having a grudge against them, I think they offer a better product, superior service, and managed to roll out these benefits in a way that delivers greater value than when Amex did the same for their competing product.

Let’s start by discussing what Chase is actually going to be doing.

Changes to the Chase Sapphire Reserve

The new annual fee will be $550, up from the current $450. The higher fee will be applicable to new customers as of January 12, 2020, as well as existing customers with renewal dates after April 1, 2020. This means anyone who applies before January 12 or who already has the card but pays their fee before April 1 will get to enjoy the lower $450 payment one more time.

In return for the $100 increase, Chase is adding two new benefits each from Door Dash and Lyft. None of these are perpetual (meaning they aren’t guaranteed to renew year after year, like your annual fee), but I suspect Chase has plans to offer something in the future to keep the card attractive.

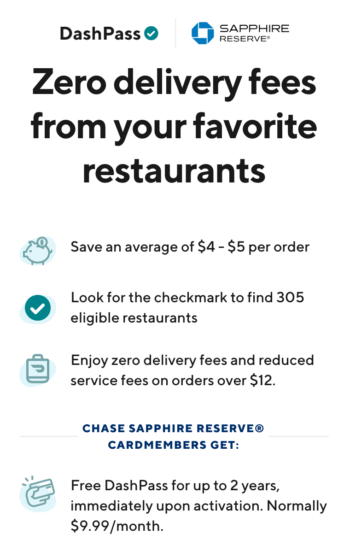

First, you can sign up to get a Door Dash DashPass that expires December 31, 2021. That expiration date is fixed regardless of when you sign up, so you have up to 2 years to enjoy it. This service waives the delivery fee at select restaurants.

Second, you get a $60 Door Dash credit for 2020 and another for 2021. This works like Chase’s existing $300 travel credit, by which I mean it’s all at once and it posts automatically. No work on your part.

Third, you can sign up for a complimentary one year of Lyft Pink, which includes a 15% discount on all rides, three free cancellations per month, and three free bike or scooter rentals. That means this year, next year, or some portion of each.

Fourth and last, Lyft rides will get 10 Ultimate Rewards points per dollar (instead of 3 points per dollar). This is an increase of 7 points per dollar.

How Much Added Value Is There?

Door Dash DashPass: I’ve already signed up with my wife’s card and consider it worth about $60 a year: delivery costs about $5 and we order out about once a month.

Door Dash Credit: The value here is, of course, another $60 per year assuming you order out.

Lyft Pink: This normally costs $20 per month or $240 per year but the value can really vary by person and location. As my wife said, “Who cancels a ride request?” My sister-in-law is an ER nurse and convinced that scooters are a death trap. We live in Texas so we own our own car and rarely use any of Lyft’s services anyway.

At best a 15% discount on $1,000 in rides per year is worth about $150, but my wife’s employer pays for 90% of those. That means we value a Lyft Pink membership at a whopping $15 annually. And you get it for one year only.

Lyft Bonus: I value Ultimate Rewards points at 1.6 cents each after significant devaluations by United Airlines and other partners. You can still redeem them for at least 1.5 cents each when you book travel through Chase’s own reservations portal. Going back to the $1,000 in purchases each year (actually $850 after the discount), this is worth an extra $850 * 7 points/$ * 1.6 cents/point = $95.20. Let’s round up and call it $100.

In total, I’d say we’re getting an extra value of $235 in 2020 and $220 in 2021. That seems worthwhile for a $100 increase in the annual fee.

Comparison to the Amex Platinum Fee Increase

What annoys me so much about American Express is their customer-unfriendly policies. Their credits are dribbled out over time or with complicated rules. This practice is called “breakage.” They hope you forget to use your monthly Uber credit. Their airline fee credit is structured so that it’s almost impossible to use if you have elite status. Isn’t the Platinum Card all about status?!

Add to that the poor customer service. I have been a cardholder of at least one Amex card for 10 years, but their computer system has been misspelling my name on billing statements for that entire period. No amount of phone calls or support requests has been able to fix that.

Some people say, “Well at least Amex has a lounge network.” But how often are those lounges overcrowded? At least before I cancelled, going to a Centurion Lounge was code for a bad experience.

When I finally called to cancel my Platinum Card, the agent asked if I ever used the lounges. I explained I moved to Austin, where there was no Centurion Lounge. I was told I should connect in Dallas or Houston. I politely replied that I did not wish to take connecting flights.

Conclusion

The new Chase Sapphire Reserve fee increase isn’t pleasant, and the new benefits certainly aren’t great. But they aren’t wholly inadequate. I think it’s possible for most people, even a sourpuss like me, to recognize more value than the fee. The way these perks are structured also makes them easy to use even though they aren’t guaranteed for the long term.

The card is still superior to the Amex Platinum Card, at least for our present situation. I might reconsider if we moved back to Seattle (where there’s a Centurion Lounge and a Delta Sky Club) and had more frequent travel to benefit from the Fine Hotels & Resorts program.

What Chase is really doing is raising the annual fee because they can. This card is incredibly popular, and I expect they’ll make more money even with a few cancellations. Go back to the TPG post and read the so-called interview at the bottom with a Chase exec. The answers barely relate to the questions posed. To paraphrase:

- Why is Chase raising the fee? We expect customers to continue to find it rewarding, i.e., they’ll keep paying us.

- Will there be an increase to the annual travel credit? No.

- Will there be more perks after 2021? The new perks only last until 2021.

So there you have it. This is a cold, calculating move. And good on them. I respect Chase because they run a good business. Am I happy about the move? No. Is it a good idea for me to cancel my card? No, I actually still get enough value to continue paying the annual fee — at least for the next two years.

Is the grass any greener at Amex?

Before you ask that question, make sure you aren’t one of those who complained about Amex raising their fee.