Bluebird by American Express is a partnership between Amex and Walmart and one of the best prepaid card products out there. You can load the card without fees at a Walmart store, and there are several ways to withdraw the funds to pay bills or write checks — also without fees. People who do manufactured spend love it because they can rack up charges with their credit cards by purchasing cash-like or debit-like products (e.g., Vanilla Reload packs and Visa gift cards), transfer the funds onto their Bluebird, and then use the Bluebird to pay off their credit cards.

Other than a few transaction fees, it’s an easy way to earn more points and miles, especially if you have a high annual spend threshold that you’re aiming for. But it’s a lot more difficult here in the Pacific Northwest because you can’t buy Vanilla Reload packs with a credit card. The best location to do this at is CVS, and there are no CVS drugstores near here for hundreds of miles.

Instead, I resort to buying Visa gift cards at my local grocery store, which I then have to use in person at Walmart. (Vanilla Reloads can be transferred online.) The closest Walmart is an 40-minute round trip, assuming there’s no traffic.

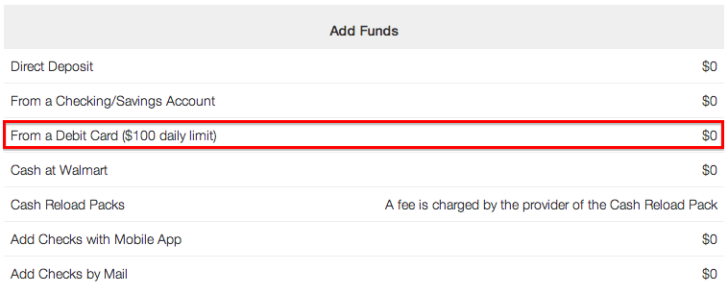

Bluebird has long had the option to load with a debit card online and charged a $2 fee to do so. Buying Visa gift cards is already more expensive than buying Vanilla Reload packs, so I never made a habit of this. Today, I and many others received notice that American Express is no longer charging this fee for online debit reloads. So do I expect to change my behavior?

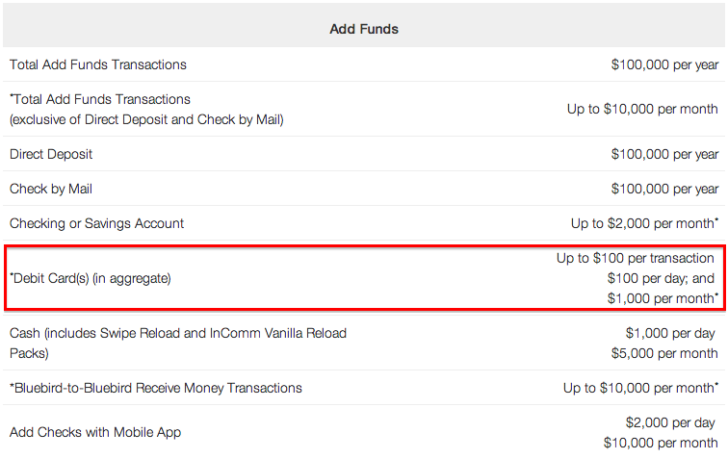

No. Online reloads are capped at $100 per day and $1,000 per month. The hassle of doing this far outweighs the inconvenience of driving to Walmart where the cap is $1,000 per day and $5,000 per month. In fact, if you go to a Walmart in the evenings, you can load $2,000 on the same day. The clock is set in the East Coast, so load $1,000 at 8:55 pm PT and another $1,000 at 9:05 pm PT before heading home.

If you’re lucky enough to live in an area that has Vanilla Reloads, you already know that they’re cheaper than these Visa gift cards. A Vanilla Reload pack costs $3.95 to load up to $500. A Visa gift card can cost $5.95 to $6.95, and office supply stores often cap them at $200 maximum value. The value proposition just isn’t there. Some of you will say: “But I this means I can use my Ink Bold to buy a gift card for 5X points and load online!” Yes, you can. That’s still a valuable transaction, even with the higher fees and lower card value. But I think it makes more sense to take that gift card to Walmart and load in person.

Two other considerations: Bluebird probably won’t like that you keep changing which debit cards are registered with your account. I know people who have been shut down (on Amazon Payments, too) for making too many changes. But there is a chance that this $1,000 online debit load is in addition to the $5,000 you can load in-store or with Vanilla Reloads. That would be a maximum of $6,000 per month. I suppose nothing stopped me from testing this before the change — it would have only cost $20 in fees — but I’ve never bothered. Hopefully one of you will report back.

Update: Amol reports that the $1,000 online debit load limit appears to be in addition to the $5,000 in-store/Vanilla Reload limit.

The main beneficiaries of this news are those who live in the rural areas that lack both a CVS and a Walmart. I can’t think of many. They’ll be limited to $12,000 in manufactured spend per year (though you could always open multiple cards for multiple friends and family…)