Allegiant plans to acquire Sun Country in a $1.5B cash-and-stock deal. Approval may hinge on politics, timing, and the fragile ULCC landscape.

A Leisure Airline Deal That Changes The Chessboard

After years of airline mergers grinding to a halt under aggressive antitrust enforcement, a new deal has landed that will test whether the logjam is finally breaking. Allegiant Air has announced plans to acquire Sun Country Airlines in a transaction valued at approximately $1.5 billion, combining two of the most uniquely positioned leisure carriers in the United States.

This is not a splashy legacy airline merger. There are no global alliances involved, no slot-hoarding battles at JFK, and no premium-heavy widebody fleets being stitched together. Instead, this is a deal squarely focused on leisure demand, secondary markets, and operating outside the bloodbath of hub-to-hub competition.

That distinction matters, because it may be exactly why this deal has a better chance of surviving regulatory review than most airline mergers attempted over the last several years. The Allegiant-Sun Country merger is the first airline combination to test the new DOJ’s resolve for tie-ups of this nature.

The Deal Terms: Cash, Stock, And A Clear Control Structure

Let’s start with the mechanics.

Allegiant and Sun Country have entered into a definitive merger agreement under which Allegiant will acquire all outstanding shares of Sun Country. Sun Country shareholders will receive $4.10 in cash plus 0.1557 shares of Allegiant common stock for each share they own. This implies a total per-share value of $18.89, representing roughly a 19.8% premium to Sun Country’s closing price on January 9, 2026.

Source: Allegiant–Sun Country press release

The leading points were as follows:

Including net debt, the transaction values Sun Country at approximately $1.5 billion. Following the merger, Allegiant shareholders are expected to own about 67% of the combined company, while Sun Country shareholders will own roughly 33% on a fully diluted basis.

The combined airline will continue to operate under the Allegiant name, remain publicly traded, and the company will be headquartered in Las Vegas, while maintaining a “significant presence in Minneapolis,” Sun Country’s home base. Allegiant CEO Gregory C. Anderson will remain CEO of the combined airline, with Sun Country CEO Jude Bricker expected to join the board of directors.

“Together, our complementary networks will expand our reach to more vacation destinations including international locations.” and the management team of the combined leisure travel company added that both carriers are customer centric organizations deeply committed to delivering affordable [travel options.]”

The companies project $140 million in annual synergies by the third year after closing and claim the transaction will be earnings-accretive within the first year post-merger. Closing is targeted for the second half of 2026, subject to shareholder approval and US antitrust review.

Why Regulators Might Approve This Deal

The most important variable in airline mergers is not network overlap. It is regulatory philosophy.

Under the Biden administration, the Department of Justice adopted an unusually aggressive posture toward consolidation, culminating in the successful lawsuit blocking JetBlue’s acquisition of Spirit Airlines in early 2024. The DOJ argued that eliminating Spirit would materially harm low-fare competition, even though Spirit was financially deteriorating.

That case cast a long shadow across the industry. But the political environment has changed, and with it, expectations around enforcement.

A Trump administration DOJ is widely expected to return to a more traditional “consumer welfare” standard that places greater emphasis on fares, capacity, and market outcomes rather than structural opposition to consolidation. Notably, the first Trump DOJ approved numerous airline joint ventures and was far more willing to accept behavioral remedies rather than outright rejection.

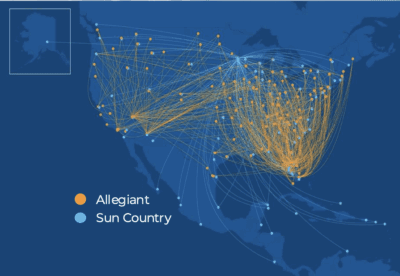

In that context, Allegiant and Sun Country have a compelling argument. They do not meaningfully compete head-to-head across most of their networks. Their business models emphasize point-to-point leisure flying, often on different days, with different seasonality, and in many cases serving entirely different origin cities. This is not JetBlue and Spirit battling over Fort Lauderdale to New York.

The companies can credibly argue that the combined airline strengthens competition against the dominant legacy carriers by creating a more resilient leisure-focused operator capable of surviving downturns without slashing service to small communities.

If regulators are looking for a deal that expands consumer choice rather than eliminates it, this one checks several boxes.

Why Regulators Might Still Say No

Now for the harder truth: airline mergers do not get reviewed in isolation.

Even though Spirit is not part of this transaction, Spirit Airlines looms over it. Spirit’s financial condition has continued to deteriorate, with repeated losses, aircraft groundings tied to Pratt & Whitney engine issues, and credit downgrades that have pushed the airline into deep distress territory.

Regulators must assess not only current competition, but future competition. If they believe Spirit is at risk of shrinking materially or exiting markets altogether, they may be more reluctant to allow additional consolidation among low-fare carriers.

Compounding this issue is the uneven financial health of other would-be competitors. JetBlue Airways remains under financial pressure following its failed Spirit merger and continues to face profitability challenges. Frontier Airlines has posted volatile results and has struggled to sustain consistent margins.

A regulator could reasonably argue that allowing Allegiant and Sun Country to combine further reduces optionality in a sector already under strain. Even if route overlap is limited, fewer independent ULCC-style operators could translate into less pricing pressure over time.

That argument may be weaker than in past administrations, but it has not disappeared.

What This Means For Spirit And Other Struggling Airlines

Ironically, this deal could either help Spirit or hurt it.

On the positive side, approval would send a powerful signal that airline mergers are back on the table, at least when structured carefully. After the JetBlue–Spirit loss, the industry has lacked a successful test case. Allegiant–Sun Country could become that precedent, outlining what regulators are willing to tolerate.

That clarity matters enormously for Spirit, which still needs a long-term solution. If this deal gets approved, it establishes that limited overlap, complementary networks, and a clear consumer benefit narrative can still pass muster.

But there is also a downside. Every merger removes a potential partner. Allegiant pairing off with Sun Country shrinks the already small pool of airlines that could plausibly acquire Spirit without triggering overwhelming antitrust resistance.

In other words, this deal may reopen the door to consolidation while simultaneously narrowing the hallway.

Allegiant And Sun Country: More Alike Than Different

At first glance, Allegiant and Sun Country appear distinct. In reality, they are variations on the same theme.

Allegiant specializes in nonstop leisure routes from small and mid-sized cities to vacation destinations, flying infrequently but profitably and leaning heavily on ancillary revenue. Sun Country follows a similar leisure-focused model but adds two stabilizers Allegiant lacks: a meaningful charter business and a cargo operation, including a long-term relationship with Amazon Air.

Operationally, both airlines favor high aircraft utilization, seasonal flexibility, and cost discipline over frequency and connectivity. Neither is trying to be a network carrier. Neither wants to compete head-on with the Big Four on hub dominance.

That alignment is precisely why the merger makes sense. Allegiant gains diversification and year-round utilization, while Sun Country gains scale and access to Allegiant’s proven leisure demand engine. This is not a culture clash merger. It is a consolidation of philosophy.

Conclusion

Allegiant’s move to acquire Sun Country for $1.5 billion is one of the most consequential airline deals in years, not because of its size, but because of what it represents. It tests whether US airline consolidation is truly frozen, or merely waiting for the right structure and the right political moment.

There is a credible case for approval rooted in complementary networks, limited overlap, and strengthened competition against legacy carriers. There is also a credible case for skepticism given the fragile state of the ULCC sector and the unresolved future of Spirit Airlines.

If approved, this deal could mark the beginning of a new, more pragmatic phase in airline merger policy. If blocked, it will reinforce that even modest consolidation remains radioactive. Either way, the outcome will ripple far beyond Allegiant and Sun Country, shaping the future options of every airline still searching for a path forward.